working capital turnover ratio ideal

The average working capital during that period was 2 million. Capital Turnover Ratio 500000 40000 125.

Working Capital Turnover Ratio Meaning Formula Calculation

A low ratio indicates inefficient utilization of working capital during the period.

. First lets calculate the average working capital. A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities. What is the Working Capital Turnover Ratio.

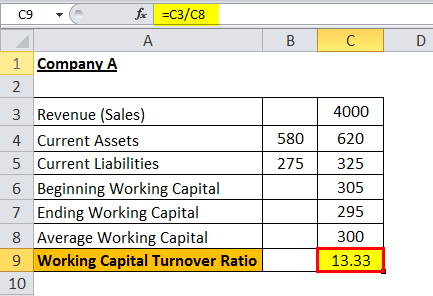

It means each of capital investment has contributed 125 towards the companys sales and this 125 seems that the utilization of capital investment is done efficiently by the company. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales. This means that for every 1 spent on the business it is providing net sales of 7.

Ad Enhance Your Balance Sheet. However where the average is not given for example in financial statements that only show closing balances then these figures may be used. This shows that for every 1 unit of working capital employed the business generated 3 units of net sales.

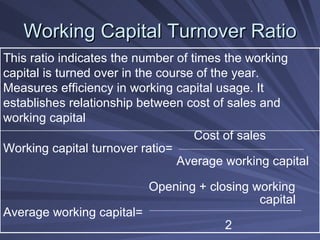

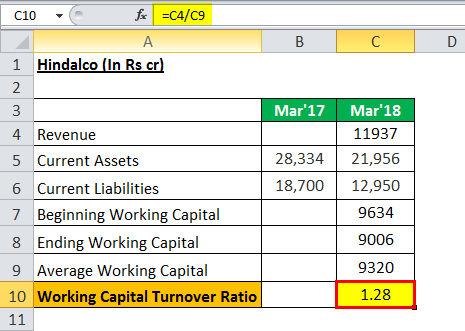

Compute working capital turnover ratio of Exide from the above information. The working capital turnover ratio is thus 12000000 2000000 60. Average Working Capital Opening Working Capital Closing Working Capital 2.

Learn How HSBCs Working Capital Solution Can Help Your Reach Your Goals. Average Working Capital is the ideal figure to use for a more accurate result. The working capital turnover ratio will be 1200000200000 6.

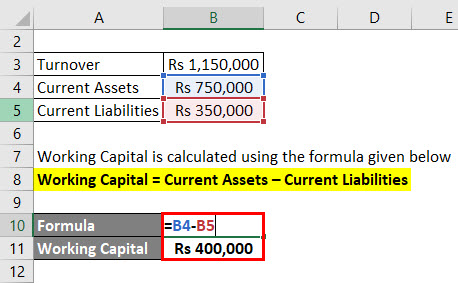

In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. This means that every dollar of working capital produces. The working capital turnover ratio for 2018 was 58 or 58 for every 100 dollar of sales.

Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. Empower Yourself And Your Career With Thousands Of Free Accredited Courses. Ad Free Cash Capital Course Accredited By The Chartered Institute Of Management Accountants.

The complete information needed to calculate the average working capital is available from the beginningclosing balance sheets. Working Capital Turnover Ratio 288. Manage Cash And Trade Flows More Efficiently.

240000 140000 280000 1000002. The working capital turnover ratio formula is as follows. WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover ratio.

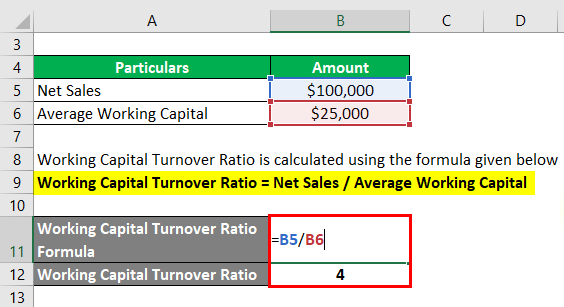

Working Capital Turnover Ratio Net SalesWorking Capital. A high working capital turnover is considered good as it indicates that. Net Sales Total Assets minus Total Liabilities In this way the amount of sales is directly related to the companys current assets and liabilities.

The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. This means that for every one dollar invested in working capital the company generates 2 in sales revenue. Working Capital Turnover Ratio Net Annual Sales Working Capital.

Value of stock x 365. Here the working capital formula is. Working Capital Current Assets - Current Liabilities.

Working capital Turnover ratio Net Sales Working Capital. Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a company on solid. Working capital turnover Net annual sales Working capital.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. 420000 60000. Therefore we are really looking at how you make the spare capital work and whether its generating enough sales to cover your liabilities.

This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for Commerce students. While analyzing a company this ratio is compared to that of its peers andor its own historical records. This company has a working capital turnover ratio of 2.

15000050000 31 or 31 or 3 Times. A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working capital. The working capital turnover ratio of.

Working capital is current assets minus current liabilities. 300000140000 214 Average working capital. A higher working capital turnover ratio is better and indicates.

Working Capital Turnover Ratio Different Examples With Advantages

Capital Turnover Definition Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Download Scientific Diagram

Working Capital Turnover Ratio Formula Calculator Excel Template

Activity Ratio Formula And Turnover Efficiency Metrics Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula And Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages