illinois electric car tax credit 2022

Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold.

The Tax Benefits Of Electric Vehicles Saffery Champness

Stipulations tied to the.

. The Federal EV Charger Tax Credit program offers a rebate of 1000 per site. Local and Utility Incentives. Learn more about the Federal Tax Credit.

Newly acquired vehiclefirst-time issuance - 406 155 title fee 251 registration fee. Light duty electric truck. Electric Vehicles Solar and Energy Storage.

Appropriate tax forms and fees payable to the Illinois Department of Revenue. Illinois new climate legislation makes available a 4000 rebate per resident as a way to incentivize them to purchase electric vehicles starting July 1 2022. The rebate program covers Level 1 Level 2 and Level 3 chargers.

This groundbreaking program is designed to bolster Illinois manufacturing already a top destination for electric vehicle EV manufacturing in the United States and to grow the ecosystem to create new capacity for EV vehicle and. While there is no illinois tax credit for. The incentive may cover up to 30 of the project cost.

If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. In 2021 Governor JB Pritzker and the General Assembly passed the Reimagining Electric Vehicles in Illinois Act REV Illinois Act into law. Depending on income level up to 4000 rebate for purchase or lease of a.

1 2022 retail vehicle buyers now receive the full tax credit on trade-ins. Additionally buyers beyond these counties can gain access to the rebates if. Applicable fee payable to the Secretary of State.

That could be coupled with a 7500 federal rebate for. Federal Tax Incentive The Federal Goverment has a tax credit for installing residential EV chargers. The duration of REV Illinois Credits may not exceed 15 taxable years when awarded to electric vehicle manufacturers component manufacturers with investments of at least 300 million Option 1.

Illinois new climate legislation makes available a 4000 rebate per resident as a way to incentivize them to purchase electric vehicles starting July 1 2022. The minimum federal PEV tax credit is 2500 but could be as much as 7500 depending in the PEVs battery capacity weight and one other key factor well discuss in a minute. Medium duty electric truck.

President Bidens EV tax credit builds on top of the existing federal EV incentive. Beginning July 1 2022 Illinois will offer a 4000 rebate for a new or used electric vehicle. Thanks to a new law effective Jan.

In 2022 taxpayers may receive up to 7500 as a federal tax credit to purchase a new electric or plug-in hybrid vehicle. View the Latest Promotions on Nissans Award Winning Lineup. If you owed 10000 in federal income tax then you would qualify for the full 7500 credit.

And if a converted vehicle submit photographs of the front back and side. Random-Number Electric Vehicle License Plates. As sales of electric vehicles continue to surge many new and prospective customers have questions about qualifying for federal tax credit on electric vehicles.

Expect also new notices of funding opportunities from the Illinois Environmental Protection Agency IEPA as they look to invest 70000000 of their Driving a Cleaner Illinois Program funds on EV infrastructure projects. Illinois Electric Car Tax Credit 2022. Heres how you would qualify for the maximum credit.

The rebate is set to go into effect on July 1 2022 and will be available for Illinois residents in counties that are paying into the rebate fund including Cook Dupage Kane Lake McHenry Will aux Sable as well as Goose Lake Townships in Grundy and the Oswego Township in Kendall County. JB Pritzker signed Illinois clean energy law on Wednesday which includes a 4000 rebate for residents to buy an. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

What Are EV PurchaseRebate Stipulations Here In Illinois. January 3 2022 0900 AM. 16 Sep 2021 1258 UTC.

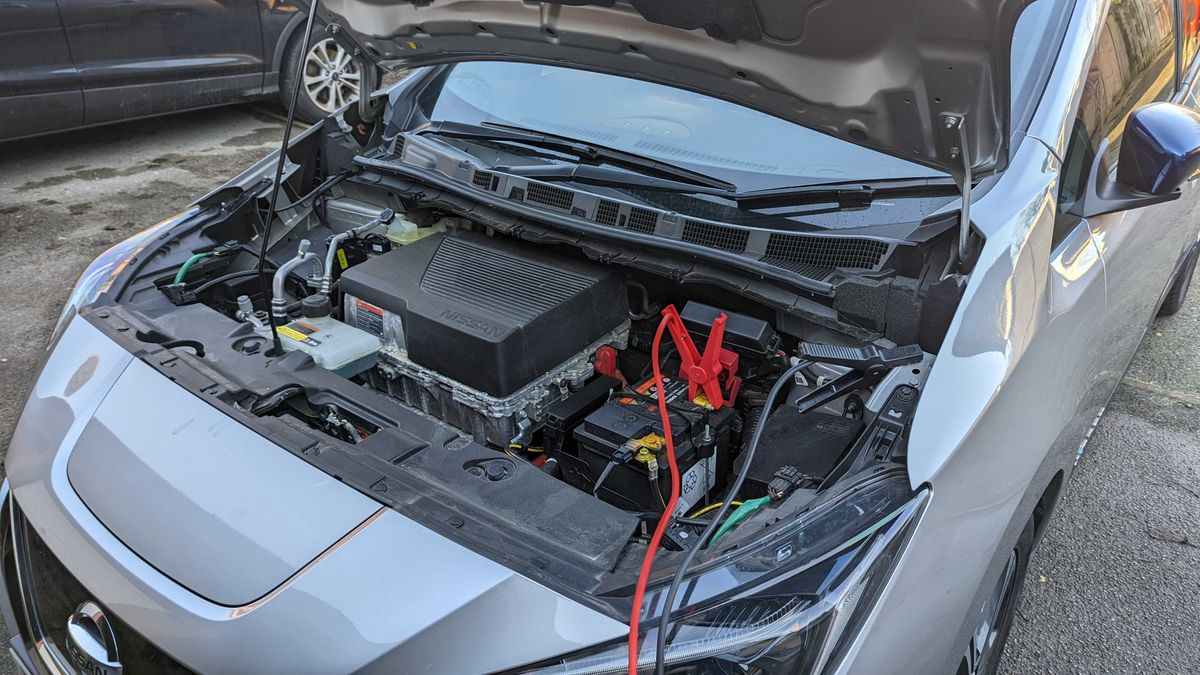

Despite the significant subsidies experts say residents remain hesitant to buy electric vehicles due to concerns over the cars charging speeds and battery range anxiety. 002 per kwh production incentive for 10 years filed on behalf of the customer electric vehicles. For example if you owned a Nissan LEAF and owed say 3500 in income tax this year then that is the federal tax credit you would receive.

March 1 2022 Bidens State of the Union address Whether its charging your vehicle or utilizing a. What Is the New Federal EV Tax Credit for 2022. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years.

7500 Purchase an electric or plug-in hybrid vehicle defined as a car with a battery capacity of at least 40 kilowatt-hours and a gas tank if any under 25 gallons. Heavy duty electric truck. This new provision part of Senate Bill 58 that was supported by both the Chicago Automobile Trade Association CATA and Illinois Automotive Dealers Association reverses the 10000 cap that was set in 2020 as part of Gov.

A clean energy bill that just passed in the state of Illinois has set a goal of adding 1 million. Light duty passenger vehicle. The EV rebate is set to go into effect on July 1st 2022.

It offers a 4000 rebate for electric vehicle purchases starting in 2022 but Hastings said thats only in counties covered by the preexisting Alternative Fuels Act meaning Cook and collar counties because they pay into a fund from which the rebates will be paid. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Will Rivian S Electric Vehicles End Detroit S Reign Over The Us Auto Industry Electric Hybrid And Low Emission Cars The Guardian

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Cloud Computing In Cars How It Enables The Future Of Electric Vehicles

Tesla Tsla Q4 2021 Vehicle Delivery And Production Numbers

Can You Jump Start An Electric Car Here S What You Can And Can T Do Tom S Guide

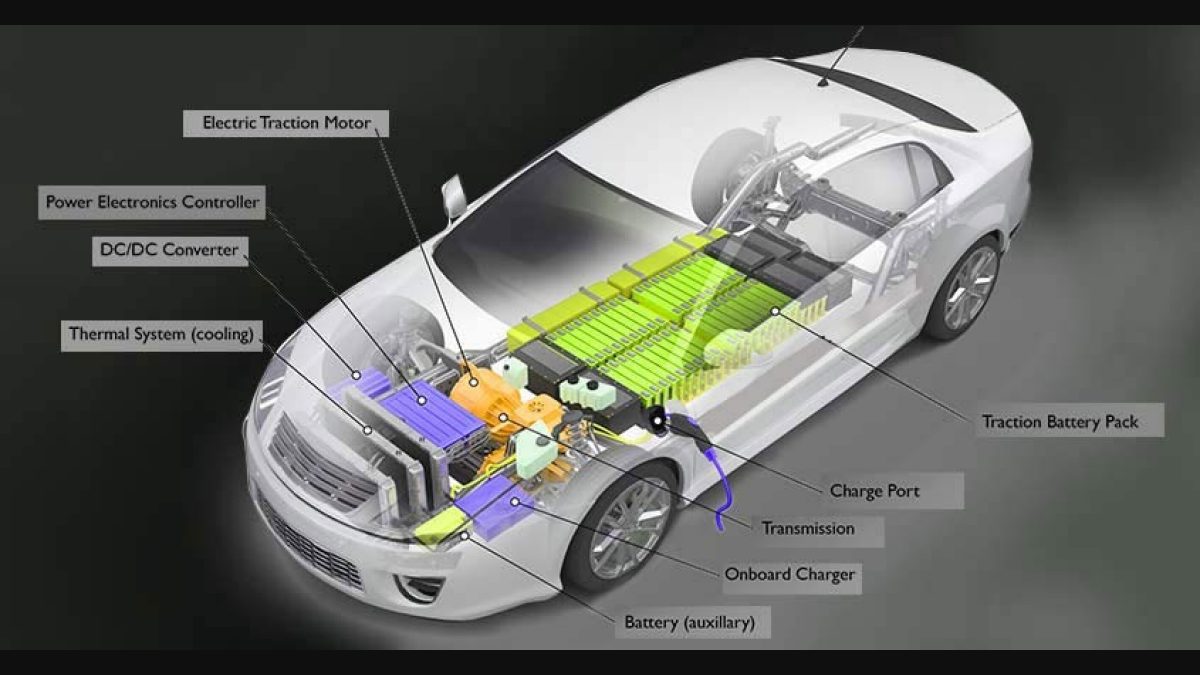

No Engine And Gearbox This Is How Electric Cars Work Fast Track English Manorama

Hyundai Ioniq5 Review One Of The Best Affordable Electric Cars

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electrics Are Cleaner Than Gas Cars And The Gap Is Growing Wired

Illinois Will Pay Residents 4k To Buy An Electric Car Autoevolution

The 5 Best Used Ev Electric Cars You Can Get

Will Rivian S Electric Vehicles End Detroit S Reign Over The Us Auto Industry Electric Hybrid And Low Emission Cars The Guardian

How Do Electric Vehicles Work Energysage

Electric Vs Gas Cars Four Ways To Know If An Ev Is Right For You

When An Out Of Warranty Ev Fails Who You Gonna Call Https T Co Vxcylubpib By Bradberman Bjmt Best Gas Mileage Mercedes Benz Benz S Class

The U S Is Among The Top 10 Cheapest Places To Buy An Ev In 2022 Electric Cars How To Plan Incentive